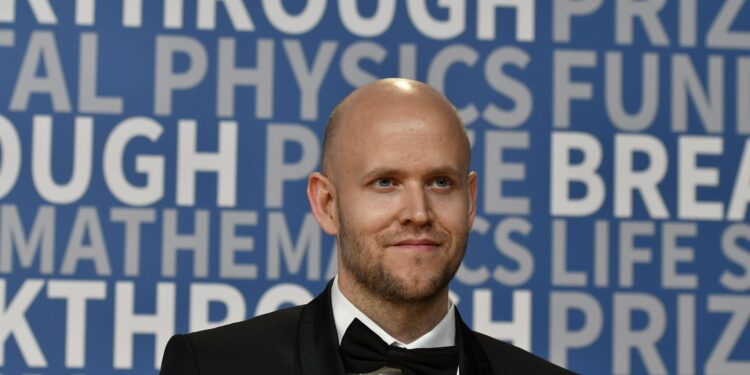

We’re gonna go forward and guess that Daniel Ek had a Vacation to recollect.

Spotify‘s Swedish co-founder and CEO cashed out USD $27.72 million in firm shares on December 23 – a good-looking increase to anybody’s late-festive-gift funds.

Certainly, throughout the course of December, in response to SEC filings reviewed by MBW, Ek cashed out some $93 million in SPOT share gross sales.

These gross sales occurred throughout three transactions: roughly $37 million was banked on December 4, adopted by $28.3 million on December 11, and that $27.7 million cash-out on December 23.

Common MBW readers will know we intently monitored Spotify share gross sales by Ek and his administration staff in 2024 – a 12 months that noticed SPOT’s inventory value rise to report ranges on the NYSE.

In late November, we calculated that Ek and his fellow Spotify co-founder, Martin Lorentzon, had collectively cashed out round $840 million in 2024 thus far.

With Ek’s December gross sales now taken under consideration, that determine – for the total 12 months of 2024 – rises near a billion {dollars}, at $932.8 million.

In whole, Ek cashed out shares carrying an mixture market worth of $376 million in 2024.

Lorentzon’s share gross sales, typically carried out through his Rosello firm, amounted to $556.8 million throughout 2024. (Not like Ek, Lorentzon didn’t money out any shares in December.)

One other govt to have loved a profitable 2024 because of Spotify shares is Barry McCarthy.

McCarthy, Spotify’s former CFO (and persevering with board member), cashed out shares with an mixture market worth of simply over USD $50 million final 12 months, in response to SEC filings.

McCarthy joined Ek in promoting some shares in December, dumping 21,000 unusual items of Spotify inventory for $10.17 million.

Spotify’s Chief Public Affairs Officer, Dustee Jenkins, additionally cashed out some inventory in December, promoting 10,399 shares at an mixture market worth of $5.22 million.

Including these and Daniel Ek’s December transactions to our working tally tells us that Spotify administration, together with firm board members, cumulatively cashed out some USD $1.25 billion in 2024.

Why was there such a flurry of insider inventory sale exercise at Spotify final 12 months? You already know the reply: SPOT’s barnstorming share value development in 2024.

On the shut of buying and selling on the New York Inventory Trade on the tail-end of 2023, Spotify’s market cap was price roughly USD $36.6 billion.

On the shut of buying and selling on the NYSE in late December 2024, that market cap had soared to a whopping USD $94.0 billion.

Spotify’s market cap even momentarily topped $100 billion in early December, because the agency’s particular person share value exceeded $500 for the primary time ever.

On the time of publication (January 6), Spotify’s share value on the NYSE is $466.67, translating to an organization market cap of $93.75 billion.

Spotify is about to announce its calendar This autumn 2024 quarterly monetary outcomes on Tuesday, February 4.

When saying its Q3 2024 outcomes in November, Spotify forecast that it will publish quarterly revenues of EUR €4.1 billion in This autumn, alongside a quarterly working revenue of EUR €481 million.

If Spotify meets that steerage, it should have generated annual revenues of roughly €15.5 billion and an annual working revenue of €1.37 billion.Music Enterprise Worldwide