Asian equities climbed in early Monday buying and selling, monitoring US friends following a constructive dialog between Donald Trump and Chinese language chief Xi Jinping forward of the US President-elect’s inauguration.

Article content

(Bloomberg) — Asian equities climbed in early Monday trading, tracking US peers following a positive conversation between Donald Trump and Chinese leader Xi Jinping ahead of the US President-elect’s inauguration.

Article content

Article content

Shares in Australia, Japan and South Korea gained. A gauge of US-listed Chinese shares jumped 3.2% Friday as Trump described the talk between the two leaders as “very good.” US futures were slightly lower in Asian trading with Wall Street closed on Monday due to a holiday.

Advertisement 2

Article content material

Trump and Xi mentioned commerce, TikTok and fentanyl, which can set the tone for relations within the early days of the brand new administration. Including to the constructive sentiment, TikTok began restoring service within the US on Sunday as Trump stated he would halt enforcement of a regulation requiring the app’s Chinese language proprietor to discover a purchaser for 3 months.

“The amicable name between Trump and Xi, whereas solely a short lived reprieve amidst irrevocable strategic competitors, is additional gasoline to reignite bullishness in equities,” stated Kyle Rodda, a senior analyst at Capital.com in Melbourne. “It’s significantly telling that Asian indices must open firmer right now due to the information, having barely moved after a lot stronger than anticipated Chinese language development knowledge on Friday.”

Nonetheless, merchants are bracing for the primary days of the Trump’s second time period. He’s planning a flurry of government orders round immigration, vitality, federal employees and regulatory reform, to shortly implement his coverage agenda upon taking workplace. The plans are stated to incorporate tightening restrictions on border crossings and establishing the mechanics to hold out mass deportations.

Article content material

Commercial 3

Article content material

“Monetary markets are more likely to be unstable within the coming weeks as they take in the small print of the incoming administration’s insurance policies,” Barclays analysts together with Ajay Rajadhyaksha wrote in a word to purchasers. “100 government orders on day one itself – on areas as wide-ranging as border coverage, tariffs, vitality, deregulation, and so forth. – is more likely to ship buyers scrambling to decipher them.”

Forward of Trump’s inauguration later Monday, China’s industrial banks will announce their one- and five-year mortgage prime charges because the world’s quantity 2 economic system suffers from persistent weak spot in home demand. The speed will probably be on maintain for a 3rd straight month because the Individuals’s Financial institution of China could also be reluctant to cut back coverage charges near-term because of stress on the yuan, in accordance with Bloomberg Intelligence.

The World Financial Discussion board’s annual assembly will get underway later Monday. Among the many group of billionaires set to hitch the pilgrimage of the wealthy and highly effective to Davos, Switzerland are Larry Fink, Ray Dalio and Marc Benioff. Trump will communicate just about to the gathering three days after his inauguration.

Commercial 4

Article content material

Merchants can even be making ready for the Financial institution of Japan scheduled coverage resolution on Friday, with about three quarters of economists in a Bloomberg survey anticipating it to hike its key charge. In a single day index swaps confirmed as a lot as a 99% probability of hike.

BOJ officers additionally see a superb probability of a charge enhance so long as Trump doesn’t set off too many fast adverse surprises, Bloomberg reported on Thursday, citing individuals acquainted with the matter.

Trump Memecoin

A digital token debuted by Trump has rattled the cryptocurrency market, attracting billions of {dollars} of buying and selling quantity whereas stoking considerations about conflicts of curiosity.

In the meantime, the broader crypto market struggled, together with a dip within the largest token, Bitcoin. It was down over 2% Monday.

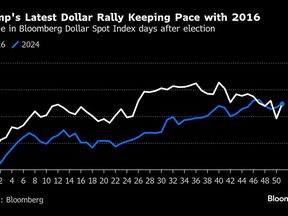

The Bloomberg gauge of the dollar has risen over 5% within the 10 weeks since Election Day, solely to snap its six-week rally on Friday. The advances have been just like the features it posted after Trump’s 2016 victory. Underpinning the transfer is a corresponding weak spot in international currencies thought of in danger from Trump’s financial insurance policies, together with the euro and Canadian greenback.

Commercial 5

Article content material

China’s yuan has additionally misplaced greater than 3% versus the greenback since Nov. 5, because of tariff dangers and a widening hole between US and Chinese language authorities bond yields. The Individuals’s Financial institution of China has deployed varied instruments to assist the forex, and depreciation expectations have been trimmed since peaking in early December.

In commodities, oil was regular forward of Trump’s inauguration.

Key occasions this week:

- China mortgage prime charges, Monday

- The annual World Financial Discussion board in Davos begins, Monday

- Donald Trump to be sworn in as forty seventh president of US, Monday

- UK jobless claims, unemployment, Tuesday

- Canada CPI, Tuesday

- New Zealand CPI, Wednesday

- Malaysia CPI, charge resolution, Wednesday

- South Africa retail gross sales, CPI, Wednesday

- ECB President Christine Lagarde and different officers communicate at Davos, Wednesday

- South Korea GDP, Thursday

- Eurozone shopper confidence, Thursday

- Turkey charge resolution, Thursday

- Norway charge resolution, Thursday

- Canada retail gross sales, Thursday

- Trump will be part of the World Financial Discussion board for a web based “dialogue”

- Japan CPI, charge resolution, Friday

- India, euro space, UK PMIs, Friday

- ECB President Christine Lagarde and BlackRock CEO Larry Fink communicate at Davos, Friday

Commercial 6

Article content material

A number of the essential strikes in markets:

Shares

- S&P 500 futures fell 0.1% as of 9:22 a.m. Tokyo time

- Cling Seng futures rose 1.2%

- Japan’s Topix rose 1%

- Australia’s S&P/ASX 200 rose 0.3%

- Euro Stoxx 50 futures rose 0.9%

Currencies

- The Bloomberg Greenback Spot Index was little modified

- The euro rose 0.1% to $1.0286

- The Japanese yen rose 0.1% to 156.12 per greenback

- The offshore yuan was little modified at 7.3344 per greenback

Cryptocurrencies

- Bitcoin fell 2.6% to $100,903.7

- Ether fell 1% to $3,198.87

Bonds

- The yield on 10-year Treasuries was little modified at 4.63%

- Australia’s 10-year yield superior one foundation level to 4.51%

Commodities

- West Texas Intermediate crude rose 0.5% to $78.29 a barrel

- Spot gold fell 0.3% to $2,696.13 an oz.

This story was produced with the help of Bloomberg Automation.

Article content material