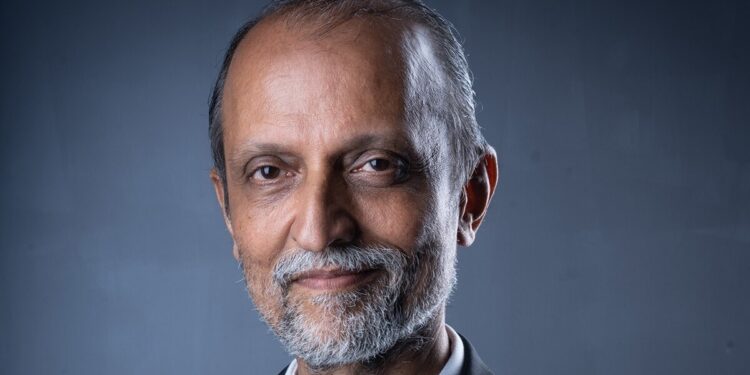

The Union Finances 2025-26 introduced widespread reduction to the center class with Finance Minister Nirmala Sitharaman’s announcement of great earnings tax cuts. People incomes as much as ₹12 lakh yearly are actually exempt from paying earnings tax, a transfer that’s anticipated to learn over 6.3 crore taxpayers, or greater than 80% of the tax base. Nevertheless, whereas many celebrated the tax reduction, outstanding economist Ajit Ranade raised crucial questions concerning the broader implications of this coverage.

“A lot jubilation about earnings tax reduce, however tens of millions will fall out of the earnings tax internet,” Ranade wrote, mentioning a possible contradiction between the federal government’s objective of widening the tax base and the brand new tax exemptions. In keeping with him, out of 80 million earnings tax filers, barely 25 million pay taxes past zero. With the revised exemption restrict raised to ₹12 lakh, which is 500% of India’s per capita earnings, Ranade argues that no different nation presents such beneficiant tax exemptions. “This additionally contradicts the target to widen the tax internet,” he added.

Ranade highlighted a startling statistic: “India has solely 7 earnings taxpayers for each 100 voters,” calling it an excessive outlier in comparison with different democracies. He defined that whereas GST (Items and Providers Tax) captures a wider part of the inhabitants, together with the poor, it results in a regressive tax burden. “GST, being an oblique tax, is inherently regressive. GST as a proportion of household earnings is greater for the poor than for wealthy people, therefore its burden is regressive,” he wrote. In distinction, direct earnings tax will be extra progressive, guaranteeing that wealthier people pay a better share of taxes.

Addressing the suggestion that India may abolish earnings tax altogether given strong GST collections, Ranade dismissed the concept: “GST is regressive. It hurts the pocket of a poor or lower-middle-class family way more than the wealthy. So the speed should come down, ideally to 10% solely.” At the moment, GST charges are a lot greater, with a median charge of 18% and a few objects taxed at 28%. “That’s not the best way to go,” he asserted.

Ranade additionally challenged the notion of “bumper” GST progress, stating, “GST progress just isn’t bumper in any respect. Previously eight years, it has not even grown on the charge of nominal GDP progress.” This, he believes, raises issues about India’s growing reliance on oblique taxes whereas shrinking the bottom of direct taxpayers.

“Simply because GST is simpler to gather doesn’t imply we rely solely on it. We’ve to make our tax system extra progressive and introduce vertical fairness—richer people pay extra tax and likewise a better proportion,” Ranade concluded. Drawing comparisons to worldwide practices, he talked about that international locations like Canada present GST rebates for low-income households to offset the regressive nature of consumption taxes. Nevertheless, he additionally acknowledged that implementing such measures in India could possibly be impractical and would complicate an already complicated tax system.