The Financial institution of England is predicted to deal Rachel Reeves a blow this week by downgrading its development outlook and warning that her October funds will drive up inflation simply days after the Chancellor of the Exchequer unveiled an enormous bundle of measures to spice up the economic system.

Article content material

(Bloomberg) — The Financial institution of England is predicted to deal Rachel Reeves a blow this week by downgrading its development outlook and warning that her October funds will drive up inflation simply days after the Chancellor of the Exchequer unveiled an enormous bundle of measures to spice up the economic system.

Article content material

Article content material

Whereas the UK central financial institution is predicted to supply some assist by reducing rates of interest for a 3rd time since August on Thursday, its new forecasts are more likely to reinforce fears that the UK is within the grip of stagflation, in line with economists.

Commercial 2

Article content material

These surveyed by Bloomberg unanimously count on the BOE to scale back charges 1 / 4 level to 4.5%, the bottom stage since June 2023. Eight of the 9 Financial Coverage Committee members are anticipated to proceed with a “gradual strategy” to loosening coverage. Catherine Mann, an exterior member, is predicted to vote to depart borrowing prices unchanged.

“It’s clear that development has materially weakened, that means the MPC will most likely downgrade its development forecasts for this 12 months,” stated Thomas Pugh, economist at accountants RSM. “Nonetheless, inflationary pressures are actually rising once more.” He predicts a complete of 4 charge cuts this 12 months to three.75%, whereas markets are priced for 3.

The BOE is caught someplace between the US, the place sturdy development and inflationary pressures final week pressured the US Federal Reserve to pause charge cuts, and the eurozone, the place the European Central Financial institution reduce charges for a fifth time final Thursday and warned of stalling development.

“The financial institution in its upcoming projections will doubtless face a extra difficult inflation and development trade-off,” stated Matt Swannell, chief financial advisor to the EY Merchandise Membership in an interview.

Article content material

Commercial 3

Article content material

Forward of the BOE determination, the Merchandise Membership downgraded its UK development forecast for 2025 to simply 1% from 1.5%, in line with a report revealed Monday. Inflation is seen remaining above the BOE’s 2% goal over the subsequent 12 months, including to warnings that the UK is drifting right into a entice of anemic development and sticky inflation.

“The UK misplaced momentum on the finish of 2024 in order that leaves it an even bigger hill to climb to realize development in 2025,” Swannell stated. Enterprise funding, a key a part of Labour’s development plan, will even take a success. EY trimmed its funding development forecast to 2% from 3% amid heightened financial uncertainty, elevated borrowing charges and the federal government’s employment tax hikes.

Final week, Reeves introduced planning and regulatory reforms and gave the inexperienced gentle to a raft of infrastructure initiatives together with a controversial third runway at Heathrow airport in a bid to resuscitate development.

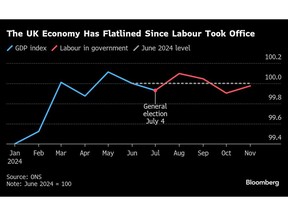

Development would be the authorities’s “primary mission,” she stated as she sought to finish the gloomy narrative of Labour’s first six months and reply to the backlash towards her tax-raising October funds. The economic system has stagnated since Labour received the overall election in July.

Commercial 4

Article content material

Past the anticipated charge reduce, the BOE’s February Financial Coverage Report is unlikely to supply a lot assist. It should replace its evaluation of the affect of Labour’s £26 billion ($32.4 billion) payroll-tax hike on employers. Bruna Skarica, a UK economist at Morgan Stanley, stated latest proof suggests corporations will cross extra on to costs than the BOE thought in November.

That, alongside increased meals and power costs, might even see the BOE enhance its inflation outlook within the first half of this 12 months by 0.3-0.4 proportion factors, she stated. Financial institution of America economists imagine the BOE will revise down its development forecasts in each the brief and long run “to replicate latest weak outturns, weak confidence, and better Financial institution Price path.” In November, the BOE was forecasting 1.5% development this 12 months. The consensus is now 1.3%.

The financial institution’s conference of utilizing the market path for charges to construct its development and inflation forecasts threatens to complicate the communication on Thursday. Markets had been betting on three quarter-point charge cuts this 12 months on Friday however the financial institution’s forecasts could have closed when solely two had been absolutely priced. Each are fewer than the 4 cuts the financial institution’s November forecasts and Governor Andrew Bailey successfully endorsed.

Commercial 5

Article content material

The Financial institution of America economists stated the MPC might “sign an implicit pushback towards market pricing” by exhibiting inflation falling in its forecasts additional beneath goal in two or three years’ time. Nonetheless, that may suggest the financial institution’s development forecasts, which additionally use the market path, understate the UK’s precise prospects, unnecessarily undercutting the Chancellor.

Former US Federal Reserve Chair Ben Bernanke has stated the financial institution ought to think about using its personal forecast for charges as a substitute as a result of the present conference dangers “clouding the interpretation of what the committee is attempting to say.” The BOE has stated it plans to make use of “situations” as a substitute.

Article content material