Over the previous couple of years, the US financial system has persistently defied expectations for a slowdown, and 2024 was no totally different.

Article content material

(Bloomberg) — Over the previous couple of years, the US financial system has persistently defied expectations for a slowdown, and 2024 was no totally different.

Article content material

Article content material

Regardless of uncertainty round a presidential election, elevated rates of interest and a cooling labor market, financial progress remained strong this yr. The US is ready to be the highest performer amongst Group of Seven nations, in line with Worldwide Financial Fund projections.

Commercial 2

Article content material

Nonetheless, the financial system was removed from good. Inflation proved gradual to recede, main the Federal Reserve to embrace a higher-for-longer method to rates of interest. The housing and manufacturing sectors continued to wrestle beneath the burden of excessive borrowing prices, and shoppers with credit-card debt, mortgages and different loans noticed rising delinquency charges.

Right here’s a better have a look at how the US financial system carried out on this yr:

Shoppers Held Up…

The reply to why the financial system exceeded expectations in 2024 is the American shopper. Whilst hiring slowed, wage progress continued to outpace inflation and family wealth reached new information, supporting an ongoing growth in family spending.

Bloomberg Economics forecasters estimate family outlays superior 2.8% in 2024 — quicker than in 2023 and almost twice their projection in the beginning of the yr.

…However Cracks Emerged…

Although shoppers are nonetheless holding up, a few of the foremost drivers of that outstanding resilience misplaced steam this yr. Individuals have largely exhausted their pandemic financial savings and have typically been placing apart a smaller share of their incomes every month.

Article content material

Commercial 3

Article content material

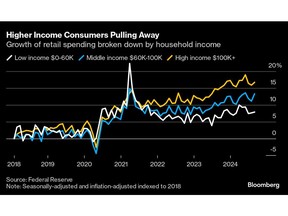

Client spending has additionally been more and more pushed by larger earners who’re having fun with a so-called wealth impact from good points in housing costs and the inventory market. That’s going down whereas many lower-income shoppers are counting on bank cards and different loans to assist their spending, with some exhibiting indicators of economic pressure like larger delinquency charges.

…Together with within the Labor Market

The primary assist for shopper spending additionally started flashing warning indicators in 2024. Hiring decelerated all year long and the unemployment charge edged larger, triggering a well-liked recession indicator. Furthermore, the variety of job openings declined and the unemployed are more and more having a more durable time discovering new jobs.

Fed officers started chopping charges in September amid issues that the job market may very well be approaching a harmful tipping level, although they’ve turn out to be extra optimistic within the last months of the yr because the unemployment charge has stabilized round ranges that stay low by historic requirements. Wage progress, in the meantime, stays regular round 4%, which ought to maintain supporting family funds.

Commercial 4

Article content material

Inflation Progress Stalled

Progress towards the central financial institution’s 2% inflation goal has stalled in latest months following a swift decline in 2023 and extra progress within the first half of 2024. One of many Fed’s most popular inflation metrics — the non-public consumption expenditures worth index excluding meals and power — rose 2.8% in November from a yr in the past.

Whereas Fed officers opted to decrease charges by a full share level this yr in an effort to take some strain off the financial system, Chair Jerome Powell has indicated that central bankers have to see extra progress on inflation earlier than making extra cuts in 2025.

Excessive Charges Damage the Housing Market…

The housing market continued to wrestle beneath the burden of upper borrowing prices. Mortgage charges, which fell to a two-year low in September, have been approaching 7% once more on expectations that the Fed will take longer to chop. Contractors continued to supply incentives to lure patrons, together with so-called mortgage buydowns and funds on their behalf, in addition to occasional worth cuts.

Whereas gross sales have stabilized considerably this yr, they continue to be beneath pre-pandemic ranges. Within the resale market — which accounts for a majority of residence purchases — the Nationwide Affiliation of Realtors anticipates the 2024 gross sales tempo got here in even decrease than final yr, which was already the worst since 1995.

Commercial 5

Article content material

…And the Manufacturing Sector

The manufacturing sector was one other sufferer of elevated borrowing prices. Funding in new constructions was hindered by excessive charges and weaker demand overseas, and plenty of corporations shed jobs in an effort to avoid wasting prices. Sturdy items producers subtracted from payrolls in all however one month this yr.

President-elect Donald Trump’s financial agenda might additionally weigh on the sector in 2025. Although Trump has promised to spice up home manufacturing, some economists and enterprise teams anticipate his plans to impose larger tariffs, deport tens of millions of immigrants and lower taxes might push up inflation and constrain the labor market, in addition to disrupt provide chains. Capital spending by US producers is seen rising at a tepid tempo subsequent yr amid that uncertainty.

Article content material