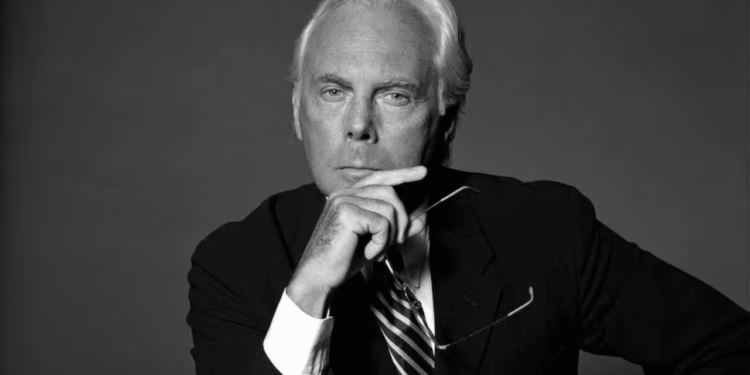

The loss of life of Giorgio Armani this month didn’t simply shut the chapter on one among trend’s most legendary designers — it opened the door to a high-stakes query: what occurs to the Armani empire now?

For many years, Armani stood as an emblem of independence in an business more and more dominated by conglomerates. However his will tells a special story — one that would see Armani’s future aligned with international giants like LVMH, EssilorLuxottica, or most intriguingly, L’Oréal.

Armani left nothing to probability. His will requires heirs to promote 15% of the corporate inside 18 months, with most well-liked patrons drawn from his long-standing enterprise companions. Inside three to 5 years, that stake may develop as excessive as 54.9%. If no appropriate companion emerges, the corporate may pursue an IPO — ideally in Milan — although the Giorgio Armani Basis will all the time retain no less than 30.1% possession to protect his imaginative and prescient. Management of the Basis goes to Pantaleo “Leo” Dell’Orco, Armani’s longtime companion, with voting rights additionally divided amongst nieces and nephews. The aim: protect the model’s DNA whereas making certain it continues to thrive underneath new management.

Among the many potential suitors, L’Oréal is the clear frontrunner. The French magnificence powerhouse already manages Armani Magnificence — a enterprise value greater than 1.5 billion yearly because of international bestsellers in perfume and cosmetics. For tens of millions of customers, Armani already means magnificence, not simply trend. L’Oréal has additionally confirmed it is aware of how you can deal with heritage manufacturers. After taking up Mugler Magnificence in 2016, it revived the label with blockbuster launches and international campaigns. It has stored names like Valentino, Yves Saint Laurent, and Prada related within the luxurious perfume house, balancing heritage with industrial success. That monitor report makes L’Oréal not only a bidder, however a pure custodian of Armani’s subsequent act.

The numbers inform a compelling story. Armani’s trend division introduced in $2.7 billion (€2.3B) in 2024, although revenues slipped 5% year-on-year. Consider its profitable licenses — magnificence with L’Oréal and eyewear with EssilorLuxottica — and the overall worth climbs to $4.5 billion (€4.25B). The catch? Vogue margins are tightening, whereas magnificence and equipment stay robust. This dynamic underscores why Armani’s future might lie with a purchaser that already excels in magnificence. In contrast to LVMH, which may fold Armani right into a crowded roster, or EssilorLuxottica, whose focus is eyewear, L’Oréal has each the connection and the income streams to information the home ahead.

The thought of a magnificence large taking management of a trend empire isn’t new. In 2022, Estée Lauder’s $2.8 billion buy of Tom Ford gave it management of the model’s identify and, most significantly, its perfume enterprise, whereas licensing out attire and eyewear. For Armani, the parallels are clear — and so they strengthen the case for L’Oréal.

For trend lovers, the stakes are emotional as a lot as monetary. Armani has lengthy represented independence, minimalism, and Italian craftsmanship untouched by company strain. His succession plan is designed to guard that spirit, however any takeover will inevitably check it. Will Armani’s signature class stay intact underneath new possession? Or will the empire shift into one thing extra industrial, extra international, much less singular?

One factor is definite: Giorgio Armani could also be gone, however the empire he constructed is getting into its most dramatic chapter but. And the world will likely be watching who takes the reins.

The put up Vogue’s Massive Guess appeared first on Way of life Media Group.